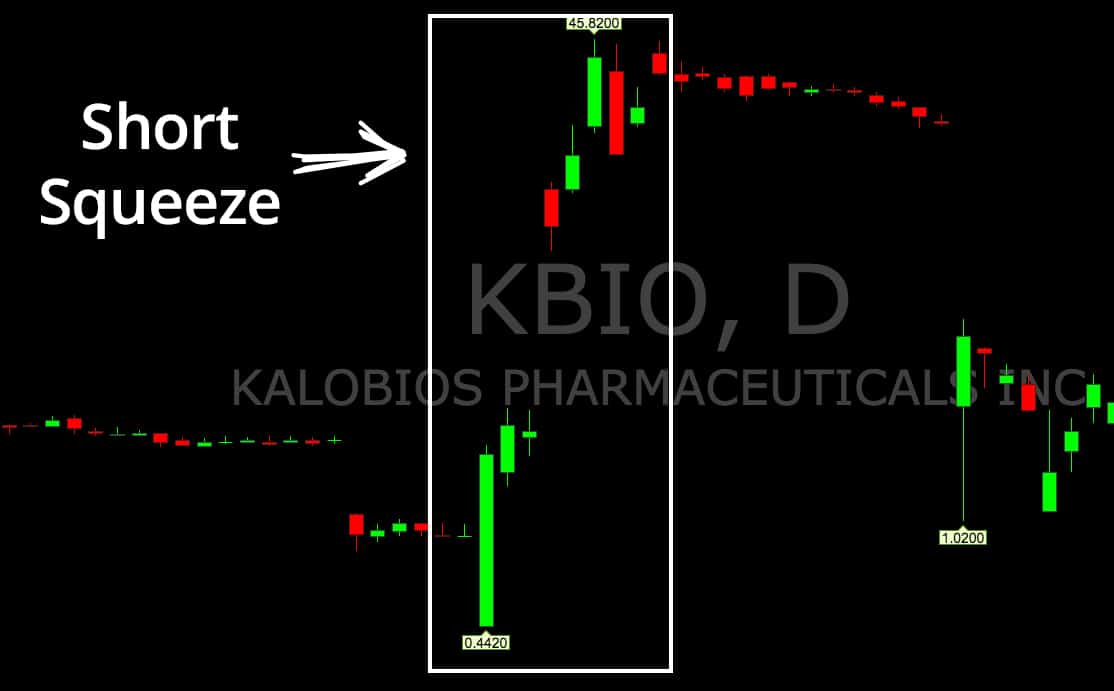

If a stock has a growth narrative and there are enough believers, the share price can go well beyond what looks reasonable by traditional fundamental metrics.Ĭlassic signs of a short squeeze can include: What makes a short squeeze so dangerous? Think of it this way: When you buy a stock, the worst thing it can do is drop to zero. As the shorts scramble to buy back and cover their losses, upward momentum can build on itself, causing the stock to move sharply higher. One big risk is when a bullish catalyst (earnings, news, technical event, etc.) pushes the stock price higher, prompting short sellers to "head for the exits" all at once. Your plan is to then buy the same stock back later-hopefully for a lower price than you initially sold it for-and pocket the difference after repaying the initial loan.) While there are potential benefits to going short, there are also plenty of risks. (Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. The aim of short selling is to generate profit from a stock that declines in value. A short squeeze can potentially be worth trading, but only if you exercise great care.A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze.Environmental, Social and Governance (ESG) Investing.Bond Funds, Bond ETFs, and Preferred Securities.ADRs, Foreign Ordinaries & Canadian Stocks.Environmental, Social and Governance (ESG) ETFs.Environmental, Social and Governance (ESG) Mutual Funds.

Benefits and Considerations of Mutual Funds.

0 kommentar(er)

0 kommentar(er)